Windsor Marketplace By

Windsor Life Settlements, LLC.

Home » Windsor Marketplace

Welcome To The Future Of Life Settlements.

The Windsor Marketplace is unlike any other digital life settlement exchange. It was built (and is currently hosted) by Salesforce.com. So, it’s fully secure, HIPAA and Financial Services Compliant. The Windsor Marketplace, powered by Salesforce.com, is “Compliance engineered for the Cloud.”

Life insurance policies listed on the Windsor Marketplace have been fully-vetted, completing “Underwriting” by certified life settlement brokers, making them more attractive to potential buyers.

Life Settlement Investors Provide At-Risk Seniors Access To Capital For Medical Bills & Retirement.

Investing in life settlements offer significant upside in terms of return on investment. However, many seasoned investors claim the monetary rewards are secondary to the self-satisfaction and gratification of knowing their capital is helping at-risk seniors. Life settlements, in that sense, can be more rewarding than other forms of investments.

Life settlement consumers are often in vulnerable positions. Many have a terminal illness and have an urgent need to access to capital to cover medical expenses and long-term care. A life settlement or viatical settlement investor offers that financial relief. In other cases, consumers will use their settlement to travel the world or add to their retirement funds.

Consumer testimonials echo this sentiment. Life settlement recipient Ted Mueller acquired his dream car with the funds from a viatical settlement.

Life Settlement Investment Strategies Continue To Drive Market Growth In 2020

The life settlement niche for investors continues to grow. With reported annual increases in investment capital entering the market, coupled with increased advertising budgets for television and digital ads, consumer awareness for life settlements has increased year over year, since 2017.

The total face value of life settlements is expected to exceed $3 billion by the end of 2020, according to some estimates, up from $2.8 billion in 2017. Opportunities abound for individual investors to purchase life insurance policies directly or to invest in them through mutual funds, which are comprised of many purchased life insurance policies.

Sample Life Settlement Investment

- Insured: Age 72

- Life Expectancy: 4 years

- Face Amount of Policy: $2,000,000

- Cash Value: $450,000

- Purchase Price of Policy: $600,000

- Total Premiums Paid by Investor over 4 Years: $60,000

- Fees and Expenses to Investor: $75,000

- Before Tax Return to Investor: $1,265,000

The investor becomes the policy’s beneficiary and assumes the responsibility for all premium payments.

The Market for Investors

The life settlement market for investors continues to grow as the population ages. Consider the following:

- The average life expectancy in the U.S. is 78.87 years old.

- 10,000 people in the U.S. turn age 65 every day.

Some estimates indicate that the average 401(k) balance at retirement currently stands at $174,100. Coupled with the ever-increasing cost of daily living expenses, housing costs, and medical expenses, the average retiree can expect to outlive their retirement savings if they survive until normal life expectancy. Retirees face even greater financial pressure if they live beyond there estimated age of death.

A commonly overlooked asset available to sell for cash is a life insurance policy. Policy owners have the legal right to sell a life insurance policy to a third-party for cash consideration.

Life Settlement Investment Risks, Considerations

Like any investment choice, there are inherent benefits and risks for investors in the life settlement market. Investors are advised to consult with life settlement brokers before investing in a life settlement.

Life settlements offer portfolio diversification. To help limit risk, investment advisors recommend diversification. Life settlements are a viable investment for those that wish to diversify with alternative investments.

The primary financial risk is that the insured will live beyond their estimated life expectancy. Every year that an insured lives beyond their expected age of death diminishes the return to the investor. Not only is the average rate of return lessened, but the opportunity cost increases because the anticipated funds cannot be used for other investment opportunities.

One way that the investor can minimize this risk is to invest in life settlement mutual funds instead of purchasing life insurance policies as an individual. By combining many life insurance policies into a single basket, the financial impact of an insured individual living beyond their life expectancy is substantially lessened, thereby helping to increase the rate of return that investors realize.

HME, DME, & Pharmaceutical Websites That Boost Cash Sales.

Real E-Commerce and Order Fulfillment For One Shockingly Low Price.

Features That Help Boost Cash Sales

A New Kind of HME, DME, And Pharmacy Website.

Health Mobius Marketplace

New HME websites include a pre-loaded e-commerce marketplace where patients can order needed supplies directly from your company website. No more updating website inventory. No more sending patients to Amazon.

Increase Mobile Orders

HME providers are boosting cash sales both in stores and in the field using mobile devices that make ordering new products fast and easy.

Wholesale Pricing

Enjoy wholesale pricing on over 25,000 cash sale products with no order minimums required. Get started to view the complete product price list.

Fast & Free Dropshipping

All orders placed on your company’s website are drop-shipped directly to your customer along with tracking numbers. No need to manage online orders.

Live Customer Service

Questions about a product or purchase order? Included with your new HME website is a chat box where your customers can chat with live customer service reps.

Email Marketing

Stay in touch with your patients and customers using emails tailor-fitted to suit their needs. Fully-managed or self-service email campaigns for newsletters and promotions.

HME Websites Enjoying

Real e-Commerce

Med Caire.com

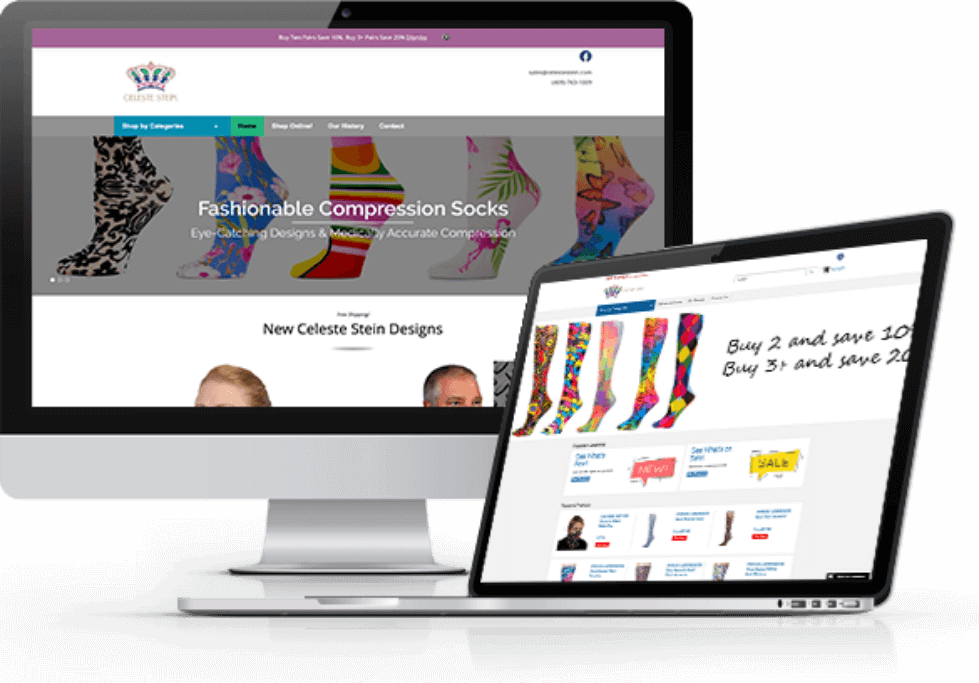

Celeste Stein.com

Main Street Medical Supply.com

Pricing

Essential

$149/Month

Setup: $1,500

Full product catalog, over 25,000 HME/DME/Pharmacy products

Access to wholesale or near-wholesale pricing with no order minimums

Fast & free drop shipping for all products

Live customer service for product and order questions

Custom website designs includes up to five web pages/posts

Premium

$269/Month

Setup $3,000

INCLUDES ESSENTIAL FEATURES PLUS:

Google Tag Manager Setup & Integration

Google Analytics Setup & Integration

BenchmarkOne Setup & Integration

Custom Forms & Applications

Company Blog Design & Setup

YoastSEO Setup & Integration

Custom website designs includes up to 15 pages/posts

Enterprise

Call For Pricing